Deutsche Post DHL Group continued to grow dynamically in the first quarter of 2021. The Group increased its revenue significantly by 22.0 percent to EUR 18.9 billion. Operating profit (EBIT) more than tripled to EUR 1.9 billion, making it the strongest opening quarter ever. All five divisions were able to significantly increase EBIT. The Group even slightly exceeded the preliminary quarterly figures published in April. With its broad portfolio of logistics services, Deutsche Post DHL Group benefited from the continued strong momentum in global e-commerce and the simultaneous recovery in world trade. Against the backdrop of the good earnings performance, Deutsche Post DHL Group has raised its short- and medium-term targets: For 2021, the Group expects EBIT of more than EUR 6.7 billion and free cash flow of more than EUR 3.0 billion. For 2023, the company forecasts EBIT of more than EUR 7.0 billion.

“We had the best opening quarter ever and were able to unleash our full strength as a Group. All five of our divisions are on track for growth and are ideally positioned to benefit from the continuing boom in e-commerce and the resurgence in global trade. Our 570,000 employees are operating our networks more efficiently than ever before. This makes me optimistic about the future”, said Frank Appel, CEO of Deutsche Post DHL Group.

For 2021, the Group expects EBIT to increase to more than EUR 6.7 billion (previously: significantly above EUR 5.6 billion) and free cash flow to more than EUR 3.0 billion (previously: significantly above EUR 2.3 billion) with gross capex amounting to around EUR 3.8 billion (previously: around EUR 3.4 billion).

For 2023, Deutsche Post DHL Group expects EBIT of more than EUR 7.0 billion, compared with a previous forecast of more than EUR 6.0 billion. This development is also reflected in an increased forecast for cumulative free cash flow of around EUR 9.0 billion (previously: EUR 7.5 to 8.5 billion) from 2021 to 2023. Over the same period, the Group will now invest around EUR 11.0 billion (previously: EUR 9.5 to 10.5 billion) in its networks.

"Because of our strategic investments in our networks, we are today in a position to benefit from the surge in demand, while simultaneously improving our efficiency. We expect further growth in the coming quarters, even with growth rates normalizing over time. We are therefore stepping up investments in our infrastructure to be able to continue to optimally serve higher shipment volumes," said Frank Appel.

In the first quarter of 2021, the Group's operating cash flow more than tripled to EUR 2.5 billion (Q1 2020: EUR 750 million). The Group's excellent financial situation improved again with free cash flow of EUR 1.2 billion (Q1 2020: EUR -409 million). In addition to the positive earnings performance, a lower cash outflow of EUR 664 million from the change in working capital also had a positive effect.

"The development of free cash flow especially stands out. This quarter we achieved an outstandingly positive result with free cash flow of EUR 1.2 billion. This performance is even more impressive when you consider that free cash flow has historically been negative in the opening quarter. The structural improvements allow us to increase our free cash flow guidance while investing more," said Chief Financial Officer Melanie Kreis.

In the first quarter of 2021, all five divisions were able to increase revenue and achieve a positive earnings performance. The Express, eCommerce Solutions, and Post & Parcel Germany divisions especially benefited from the sustained momentum in e-commerce leading to a sharp rise in shipment volumes in the national and international parcel business. Thanks to the high utilization of their networks, the divisions achieved a significant jump in earnings. Global Forwarding, Freight and Supply Chain but also Express benefited particularly strongly from the rapid recovery in world trade and the growing B2B business.

The Express division was able to utilize its unique global infrastructure very well, in particular its international flight capacities, and thus generated an outstanding EBIT of EUR 961 million (Q1 2020: EUR 393 million). Revenue increased by 32.5 percent to EUR 5.5 billion. Volumes in the time-definite international express (TDI) business achieved double-digit percentage growth in all regions of the world. Global growth amounted to 26.3 percent. At 17.5 percent, the EBIT margin significantly exceeded the prior-year figure (Q1 2020: 9.5 percent).

Shipment volumes increased significantly in all regions. Growth was particularly dynamic in the US and the Netherlands. Thus, revenue developed positively, increasing by 46.0 percent to EUR 1.5 billion. On this basis, the division was able to considerably increase EBIT from EUR 6 million in the prior-year quarter to EUR 117 million in the first quarter of 2021. The division significantly increased its profitability in the international parcel business through higher utilization of its networks. The EBIT margin increased in the past quarter to 8.0 percent (Q1 2020: 0.6 percent) and was thus already above the long-term target of 5 percent.

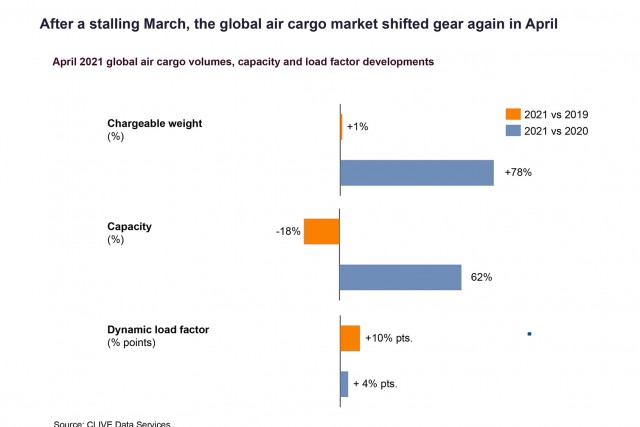

Global Forwarding, Freight increased its revenue by 32.7 percent to EUR 4.8 billion in an environment

characterized by continuing capacity shortages on the international transport markets. Additional

cargo capacity on international passenger aircraft remained limited. Cargo space was also in short

supply at sea. The noticeable increase in world trade further intensified the price and margin trends. In

a challenging environment with further elevated competition for available transport capacity, the

division succeeded in increasing air freight volumes by 18.2 percent, while ocean freight volumes

increased by 8.8 percent. The main driver here was business in Asia. As a result of productivity

improvements, the division succeeded in significantly increasing the EBIT/Gross Profit conversion ratio.