The International Air Transport Association (IATA) released data for August 2024 global air cargo markets showing continued strong annual growth in demand.

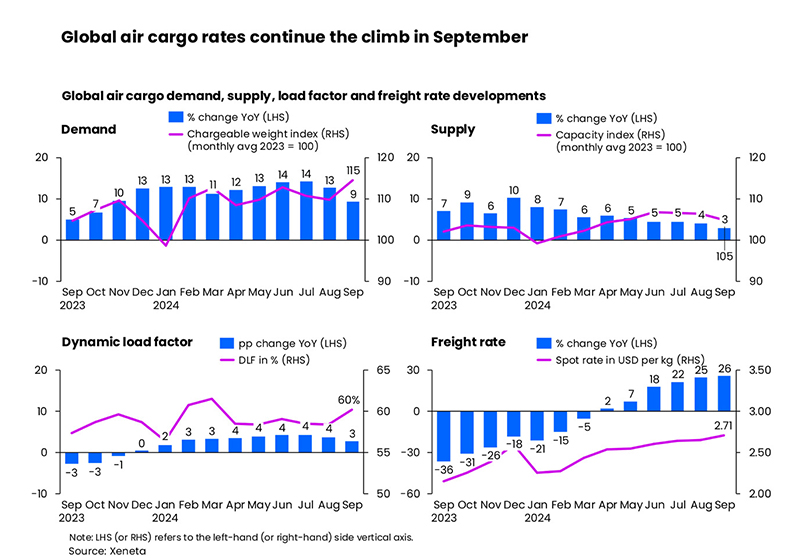

• Total demand, measured in cargo tonne-kilometers (CTKs*), rose by 11.4% compared to August 2023 levels (12.4% for international operations). This is the ninth consecutive month of double-digit year-on-year growth, with overall levels reaching heights not seen since the record peaks of 2021.

• Capacity, measured in available cargo tonne-kilometers (ACTKs), increased by 6.2% compared to August 2023 (8.2% for international operations). This was largely related to the growth in international belly capacity, which rose 10.9% on the strength of passenger markets. Industry-wide capacity has reached an all-time high.

“We continue to see very good news in air cargo markets. The sector recorded a second consecutive month of record high demand year-to-date. Even with record levels of capacity, yields are up 11.7% on 2023, 2% on the previous month, and 46% above pre-pandemic levels. This strong performance is underpinned by slow but steady growth in global trade, booming e-commerce, and continuing capacity constraints on maritime shipping,” said Willie Walsh, IATA’s Director General.

Several factors in the operating environment should be noted:

• Industrial production stayed level in August month-on-month and global cross-border trade fell marginally with -0.3%.

• In August both the Purchasing Managers Index (PMIs) for global manufacturing output and the PMI for new export orders were below the 50-mark at 49.9 and 48.4 respectively, indicating contraction.

• Inflation saw a mixed picture in August. In the US and EU, inflation rates fell to 2.6% and 2.4% respectively, the lowest rates since 2021. In contrast, Japan’s inflation ticked up 0.3 percentage points to 3.0%, the highest rate in ten months. China’s inflation rate continued its moderate upward trend, growing by 0.1 percentage points to reach 0.7%, the highest rate in six months.