The growth of ‘general cargo’ air freight tonnages is outpacing that of ‘special cargo’ products so far in 2024, new analysis from WorldACD Market Data has revealed, reversing a trend in recent years in which demand from air cargo shipments requiring special handling and shipping, has broadly outperformed general cargo.

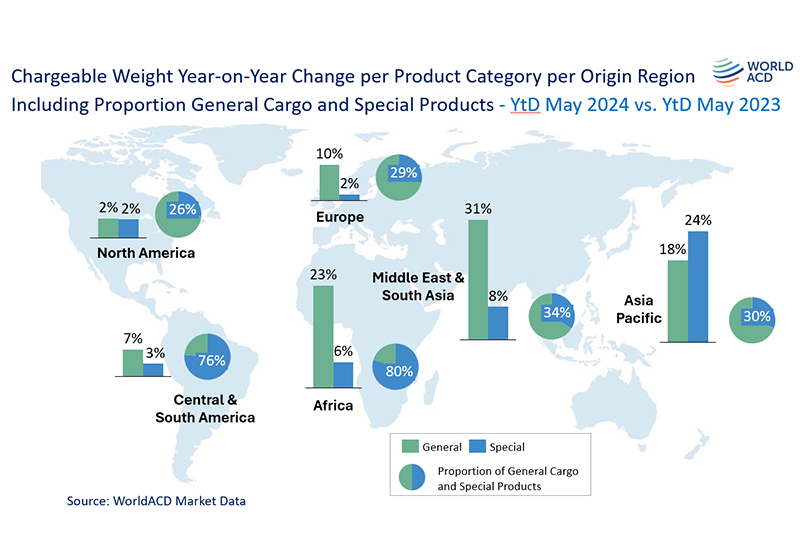

Analysis of the first five months of 2024 by WorldACD, based on the more than 2 million monthly transactions recorded via its database, indicates that total worldwide chargeable weight from January to May 2024 was up +12% compared with the equivalent period last year, with general cargo demand up by +13%, year on year (YoY), and special cargo growth trailing at +10%, as shown in the chart below. This contrasts with findings late last year by WorldACD that in the first eight months of 2023, general cargo tonnages fell by -12%, YoY, whereas tonnages of special cargo products as a whole grew by +3%, on a worldwide basis, at a time when the market as a whole was down by -7%, YoY.

One factor for this is the strong growth since the start of last autumn in cross-border e-commerce traffic, which often flies in bulk as general cargo rather than within a special product category, as well as conversion of sea freight to air cargo and sea-air resulting from disruptions since last November to container shipping due to the attacks on vessels in the Red Sea. These two factors have contributed to significant YoY rises in chargeable weight in the five months to May 2024 (year-to-date May, or YtD May) from Asia Pacific (+20%) and Middle East & South Asia (MESA, +22%).

Examining the performance of some of the major air cargo product categories so far this year highlights some interesting trends, including extremely strong (+25%) growth in worldwide shipments of vulnerable/high-tech cargo, along with a +25% increase in meat shipments. Fruit & vegetables traffic grew by +10%, valuables and flowers by +6%, whereas dangerous goods traffic grew by just +2%, and pharma/temperature-controlled traffic by +1%. Meanwhile, fish & seafood saw a small decline (-1%), while live animal shipments dropped by -7%, and human remains by -10%, YoY.

Globally, the proportion of special cargo products within the total market averaged 35% in the five months to May 2024. But analysis according to the origin region of the cargo reveals some significant differences in both their ratios and their respective rates of growth (see chart below). For example, general cargo makes up around 70% of the key Asia Pacific origin market, although the growth of special cargo from Asia Pacific (+24%) is higher this year than for general cargo (+18%), analysis by WorldACD reveals. The +24% is the result of strong growth for all Asia Pacific origin special product categories – except for pharma/temp, which fell -4%, YoY. Notable growth areas included +30% in vulnerables/high-tech (the #1 category in terms of special cargo business/kgs from Asia Pacific); a +16% rise in fruits & vegetables (the #2 category); and a +67% increase in meat shipments (the region’s fifth-largest special cargo category).

Meanwhile, the market shares held by freight forwarding companies of different sizes remains more or less stable on a worldwide basis, according to analysis by WorldACD, with ultra-large air freight forwarders (those managing more than 500 million kgs per year) maintaining their market share of 25%. There was a slight increase from 8% to 9% in the share held by medium-sized freight forwarders (those managing between 50 million and 100 million kgs).

Significant differences persist between the various main global regions, with ultra-large forwarders holding more than 30% of the market in Europe (36%) and North America (31%), but less than 20% in Africa (15%), MESA (17%) and Asia Pacific (19%), with Central & South America close to the average at 26%.