Worldwide air cargo tonnages continued to rebuild in the third week of 2025 following their seasonal drop in the final days of December and the start of this year, although spot rates continue to edge downwards.

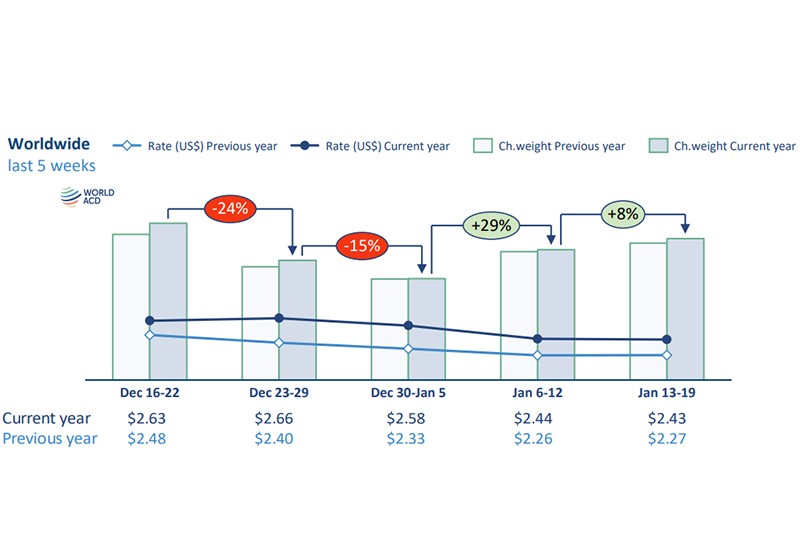

According to the latest figures and analysis by WorldACD Market Data, worldwide air cargo tonnages regained +8% in week 3 (13 to 19 January), after rebounding +29% the previous week. That follows a total drop of around -35% in the last week of December and the first week of 2025, taking worldwide tonnages in week 3 back up to around 90% of their levels in the last full week before Christmas. Year on year (YoY), tonnages were up in week 3 by +3%, globally (and +2% for week 2 and 3 combined).

Average global rates remained more or less stable at US $2.43 per kilo in week 3, based on a full-market average of spot rates and contract rates, around +7% higher than in week 3 last year. Average worldwide spot rates dropped by a further -3%, week on week (WoW). But they stand +16% higher than in the same week last year, with spot prices from Middle East & South Asia (MESA) up by +54% YoY, and rates from Asia Pacific origins +20% higher.

Spot rates from Asia Pacific to Europe dipped by further -4% in week 3 to an average of $4.35 per kilo. That’s down by around -15% compared with their level in week 49 ($5.14 per kilo), but it’s still up, year on year, by +31%.

Meanwhile, Asia Pacific to the USA tonnages rebounded in week 3 by a further +7% following a +11% recovery the previous week, taking them back to around -16% below their early December peak levels recorded in week 48. Asia Pacific to USA spot rates have dropped, WoW, for five consecutive weeks from their December peak of $6.89 per kilo in week 50 to $5.21 per kilo in week 3, although they are still up +29% compared with the equivalent week last year.