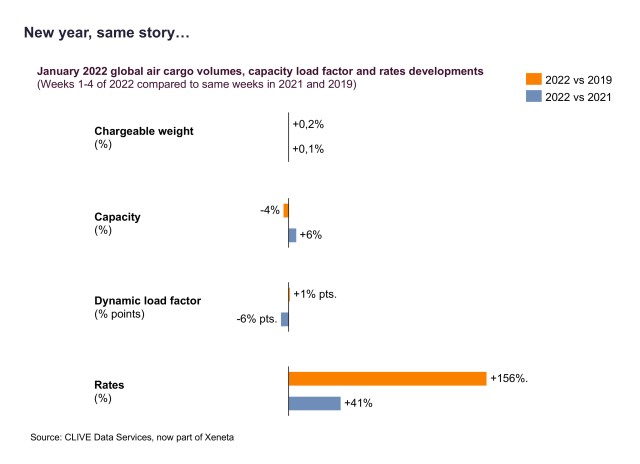

Against a backdrop of continuing market uncertainties, general air cargo volumes in January 2022 recorded a modest 0.1% increase in chargeable weight compared to the opening month of last year, according to the latest industry analysis by CLIVE Data Services.

Volumes were also on a par with the pre-pandemic January 2019 level at +0.2%.

As the air cargo industry enters a new year, CLIVE’s weekly and monthly analyses of the general air cargo market continues to measure performance to the pre-covid 2019 level, as well as giving 2021 year-over-year comparisons, to provide a meaningful assessment of its current performance.

Cargo capacity in January 2022, compared to the first month of 2019, was -4%, and up +6% versus January 2021, while CLIVE’s ‘dynamic loadfactor’ – which measures both the volume and weight perspectives of cargo flown and capacity available to produce a true indicator of airline performance – stood at 62%, +1% pts higher than in January 2019, but -6% pts below the opening month of last year.

Airfreight rates remained high, compared to the pre-Covid level, at +156% in January 2022 versus January 2019, although this was the first time in six months that the gap with pre-pandemic rates declined month-over-month, following December’s +168% rise. Compared to January 2021, air cargo rates last month were +41%.

CLIVE, which earlier this month was acquired by Xeneta, the leading ocean and air freight rate benchmarking, market analytics platform and container shipping index, advises the air cargo market to be cautious before drawing strong conclusions based on January’s performance.

“We see this as a respectful start to 2022 by an air cargo market still dealing with uncertainties caused by Covid, as sick-leave and quarantine rules continued to affect many industries and countries. We can see that the global air freight supply chain remains fragile, with airlines cancelling flights upfront because of the lack of crew. January has also reminded us that Covid isn’t the industry’s only concern. During the month, we saw other aviation disruptors, including 5G concerns in the U.S, extreme winter weather conditions impacting flight schedules, and Chinese New Year, which began two weeks earlier than in 2021. Measured against all these factors, January’s performance shows there is still a good degree of resilience in the global air cargo market,” said Niall van de Wouw, formerly Managing Director of CLIVE and now Chief Airfreight Officer at Xeneta.