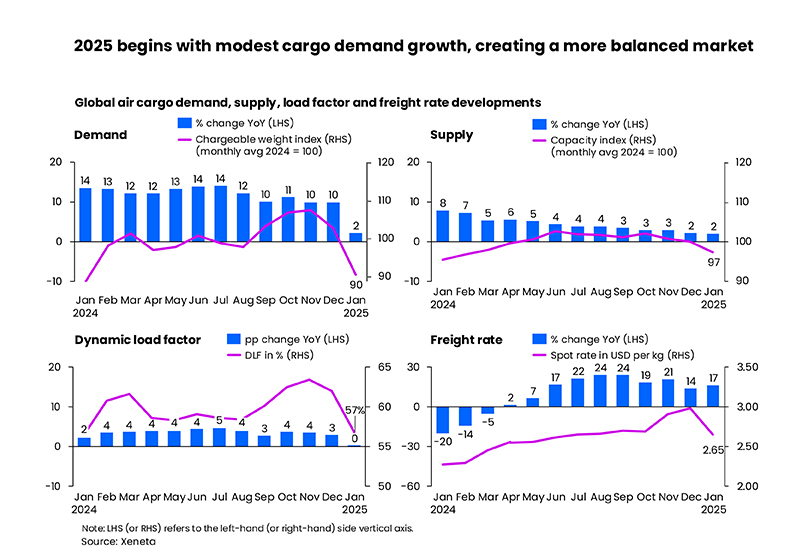

2025 began with lower-than-expected growth in global air cargo demand in January of just +2% year-on-year compared to the double-digit monthly increases throughout last year but fears of a trade war over tariffs impacting volumes and growth forecasts for the year are premature, say industry analysts Xeneta.

January’s data was impacted by the earlier Lunar New Year reducing volumes out of China, but the big drop in demand was still as a surprise, says Xeneta’s Chief Airfreight Officer, Niall van de Wouw.

However, van de Wouw sees no immediate reason to change Xeneta’s +4-6% growth forecast for global air cargo in 2025 despite the market’s nervousness over new tariffs introduced by the United States – particularly on China -and their subsequent retaliation.

“The lower growth in air cargo demand in January was not down to President Trump, nor, entirely, the earlier Lunar New Year. It also compares to an unusually high comparison in January 2024,” van de Wouw said.

“Nonetheless, the air cargo market in entering a period of uncertainty, which makes planning extremely challenging.

“The implementation of tariffs by the US and the responses of China, Canada, and Mexico are just the start of a negotiation. It’s all transactional. We could end up in a global trade war, but in the case of President Trump, we have someone who’s ready to negotiate everything and the rest of the world can influence the outcome, as we have already seen. The consistency here is he’s looking for a deal,” van de Wouw said.

Global air cargo chargeable weight in the first month of the year grew just +2% year-on-year, influenced also by the diminishing impact of ocean shipping disruptions.

As anticipated, global air cargo capacity showed a similarly modest growth of +2% in January, lowering the dynamic load factor to 57% in January, on par with a year ago. Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

Nevertheless, global air cargo spot rates in January remained +17% higher than a year ago, reaching USD 2.65 per kg and +56% above pre-pandemic 2019 levels. These elevated rates can be attributed to the e-commerce boom, limited air cargo capacity from slow aircraft production, flight rerouting due to Russian airspace closures, and the delayed adjustment of freight rates to supply-demand changes.

Month-on-month, January’s global air cargo spot rate fell -11%, a slower decline compared to the same period a year ago (-13%).

In terms of corridor trends, fronthaul trades on major global corridors continued to rise year-on-year in January. The largest increase was seen in trade from the Middle East and Central Asia to Europe, with the air cargo spot rate surging +63% from a year ago to USD 2.59 per kg, driven by ongoing Red Sea disruptions. This was followed by the Europe to North America corridor, where the spot rate grew +24% year-on-year to USD 2.36 per kg.