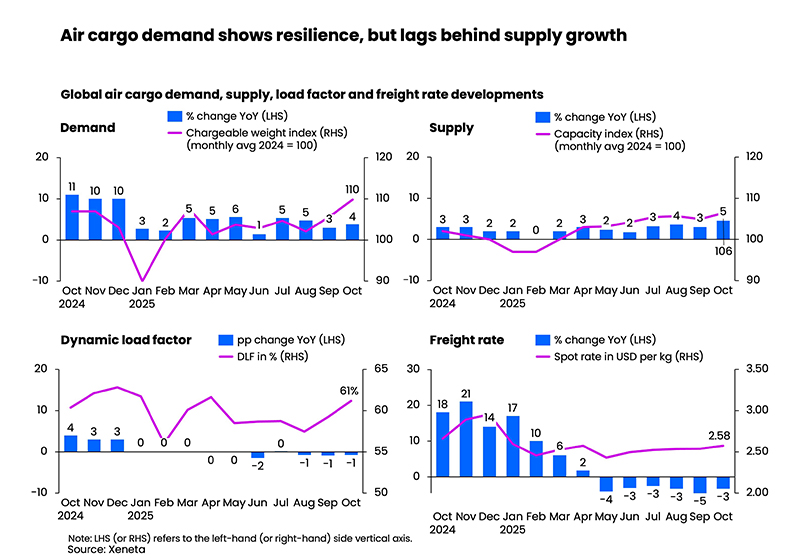

Global air cargo volumes rose by a stronger-than-expected +4% year-on-year in October, even as overall growth momentum showed clear signs of slowing. Analysts at Xeneta note that while the performance aligns with their forecast of +3–4% demand growth for 2025, the market’s underlying trends point to increasing headwinds for airlines and freight forwarders. According to Niall van de Wouw, Xeneta’s Chief Airfreight Officer, conditions are shifting in favor of shippers as rates decline and competition intensifies.

Despite growth in total volumes, air cargo spot rates fell for a sixth consecutive month, dropping -3% year-on-year to USD 2.58/kg, while contract rates declined even faster by -8% to USD 2.31/kg. This continued rate erosion reflects a more subdued outlook and growing pressure on profitability across the logistics sector. Notably, demand growth lagged behind supply expansion for the second consecutive month, suggesting an emerging capacity surplus.

A major concern is the -6% drop in Europe–North America volumes, which van de Wouw describes as a potential “bellwether for global trade.” This corridor, less influenced by the U.S. de minimis ban, typically serves as a proxy for broader economic health; its weakness signals a cooling in general airfreight demand. While global trade avoided contraction, the Transatlantic slump and slowing rate growth (only +4% year-on-year, down from +23% earlier in 2025) highlight fragile market conditions.

Regional performance diverged sharply. Asia–Europe lanes benefited from a +62% surge in China-to-Europe e-commerce exports in September, offsetting weakness on Transpacific routes where China-to-U.S. e-commerce volumes fell -34%. This shift in trade patterns is driving freighter capacity reallocation from North America to Europe, tempering rate declines on the Asia–Europe corridor (-5% year-on-year) compared with steeper Transpacific drops. The data suggests e-commerce remains a key stabilizer for the industry, though highly uneven across regions.

Looking ahead, Xeneta expects modest rate stabilization on the Transatlantic route as airlines trim capacity for winter, but emphasizes that forwarders will increasingly prioritize cost control amid disappointing revenues. Van de Wouw warns that as organic market growth slows, competition for market share will intensify, putting further downward pressure on rates into 2026.

In essence, while headline growth remains positive, the underlying trend points to a cooling airfreight market, shifting pricing power to shippers. Rate declines, weaker Transatlantic trade, and cost-cutting pressures collectively signal a turning point for global air cargo—a move from recovery-driven expansion toward a more buyer-friendly, margin-squeezed environment.